| « Dear Daddy, What would you say to your Dad today if you could | Live Oak Music Festival Good for Family, KCBX Public Radio » |

C Major Augmented Cash

My friends, I don’t usually play a musical instrument, but when I do, I play the bass guitar. I like that because I only have to play one note at a time. Chords scare me. I know a lot less about the circle of fifths than I do about the circular glazed at Krispy Kreme. You start talking F demented fourth or G distinguished sub seventh to me and I’m lost. But, if you ask me how C can augment my bottom line, I’m there, in a major way.

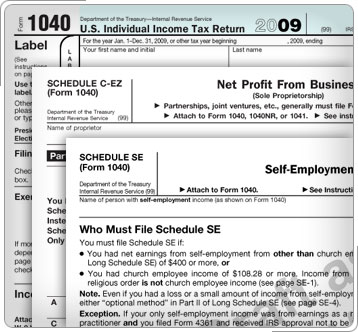

Everyone in a working band should know the variations of “Schedule C.” That is the most important chord in your annual 1040 tune, the one that you play for the IRS on April fifteenth. “Schedule C” is the IRS form for “Profit or Loss from Business.” If you play in a band and you occasionally get paid for it, guess what? You are in business! From Bakers to Bankers, the folks that make money are businesses. Your band is one of them things.

I need to insert a little disclaimer here. I am not an accountant and please do not take my opinions as legal facts. The last guy that I helped with his taxes was a Chicagoan named Alfonso Capone, and, after my advice, he received a free island vacation, courtesy of the United States legal system. So, with that disclaimer dually noted, let’s talk about how “Schedule C” can save you big bucks.

When you receive money for playing music, it is taxable whether you are an individual or a business. However, as a business, any money that you spend to make these paydays happen is considered an expense and is tax deductible. Items like: strings, picks, amps, fuel, vehicle expenses, insurance, roadie pay, studio fees, cell phone bills and – deadly to bands – business cards. Don’t forget lunches, dinners, advertising, web sites, motels, stage clothing and the list goes on and on.

Plus, here’s another flash: there is nothing in the tax code that requires you to be a good business man, or woman, as the case may be. You can be dumb as a rock when it comes to running your business and as long as the paperwork is filled out correctly and filed in a timely manner you are a business according to the IRS. You don’t need a city license, sales tax permit, commercial location or a new hairdo.

There is one caveat, however. You must show a profit in one of the first three years of your businesses operation or the IRS can declare your business to be a hobby. If they do that then you can only deduct your expenses up to the amount of your musical income. Now you may be thinking that sounds like a good deal, not having to pay income taxes on any of your gig wages, but, follow me here, as long as you can make a profit, it only has to be one dollar, in one of those first three years, then your musical losses may be applied to your ordinary income.

If you are reading this, there is a distinct probability that you are in a band, and, our statisticians have declared that there is even a greater likelihood that you have what is euphemistically referred to as a “Day Job.” It’s purpose? Obviously, supporting your addiction to the possibility of attaining musical stardom. If you do have said “Day Job,” then you are likely to be a W-2 worker. That’s when you have both “Gross Pay” and “Take-Home Pay.” Yes, Uncle Fed removes that portion of your pay that he calculates will be taxes, before you ever see it. Then, next year, you receive a tiny portion of it back, called an Income Tax Refund, and you are giddy with your newfound wealth for about a day and a half.

Here’s the bottom line. If you are in an average tax bracket, about 30% of your pay goes to income taxes, which our government then converts into stimulus and bail out packages to keep the denizens of Wall Street in Fat City. How would you like a little honest pay back? For every dollar that you spend on your musical career that exceeds your musical income put thirty cents back into your pocket. So if music costs you ten dollars more than you make, you get three dollars back, a hundred dollars more and you get thirty bucks back, a thousand dollars and you get three hundred back. NOW DO I HAVE YOUR ATTENTION?

When you put forty dollars of overpriced petro fuel into your van to get to a gig, get a cash receipt, because you are going to get twelve dollars back from “Uncle Got Ya.” This “C” is sounding more major all of the time, isn’t it?

Musicians are creative people. They write songs, and since tunes are now your business, any funds that you expend to further your work are tax deductible. I personally find that a sexy pair of black fishnets can bring out the muse in me, how about you. Who can say what inspires creativity?

One place not to scrimp is to make sure that you get a good accountant. Also, don’t even try and cheat the government; there are more island vacations available. But do make sure that you get every legal deduction that you are entitled to. I have a friend who owed the IRS $40,000. When he added up his receipts for the last seven years of music, they came to $186,513.12; he wound up with a tax refund. Keeping good records will make you a lot more cash than hocking CDs from the bandstand after a gig.